2023 paycheck calculator

Trade-in Value Get a cash value for your car. In a few easy steps you can create your own paystubs and have them sent to your email.

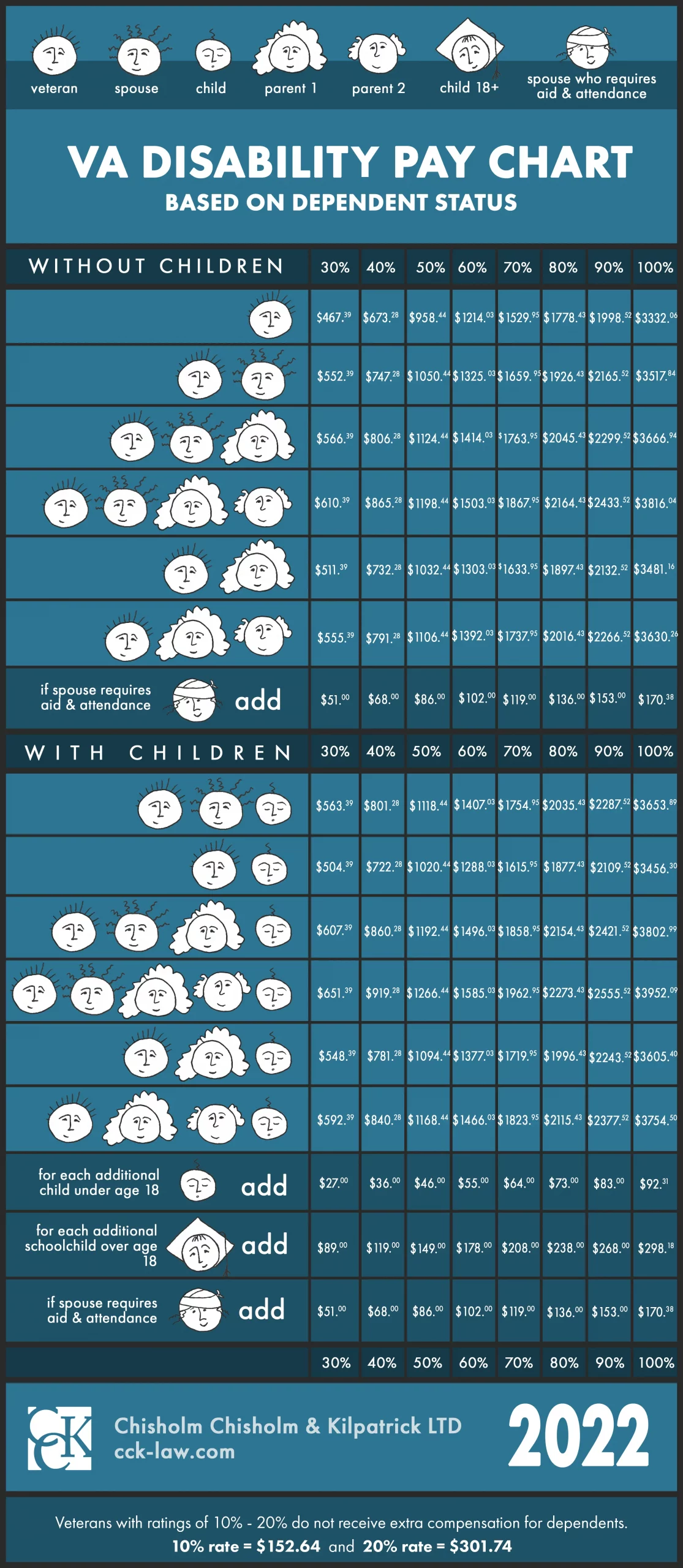

Projected 2023 Va Disability Pay Rates Cck Law

A 9 cost-of-living adjustment to Social Security in 2023 would add about 150 to monthly checks on average or an additional 1800 a year.

. Start the TAXstimator Then select your IRS Tax Return. See where that hard-earned money goes - with UK income tax National Insurance student. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

2023 Wage Benefit Calculator. Employers can enter an. Sign up for a free Taxpert account and e-file your returns each year they are due.

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Get a head start on your next return.

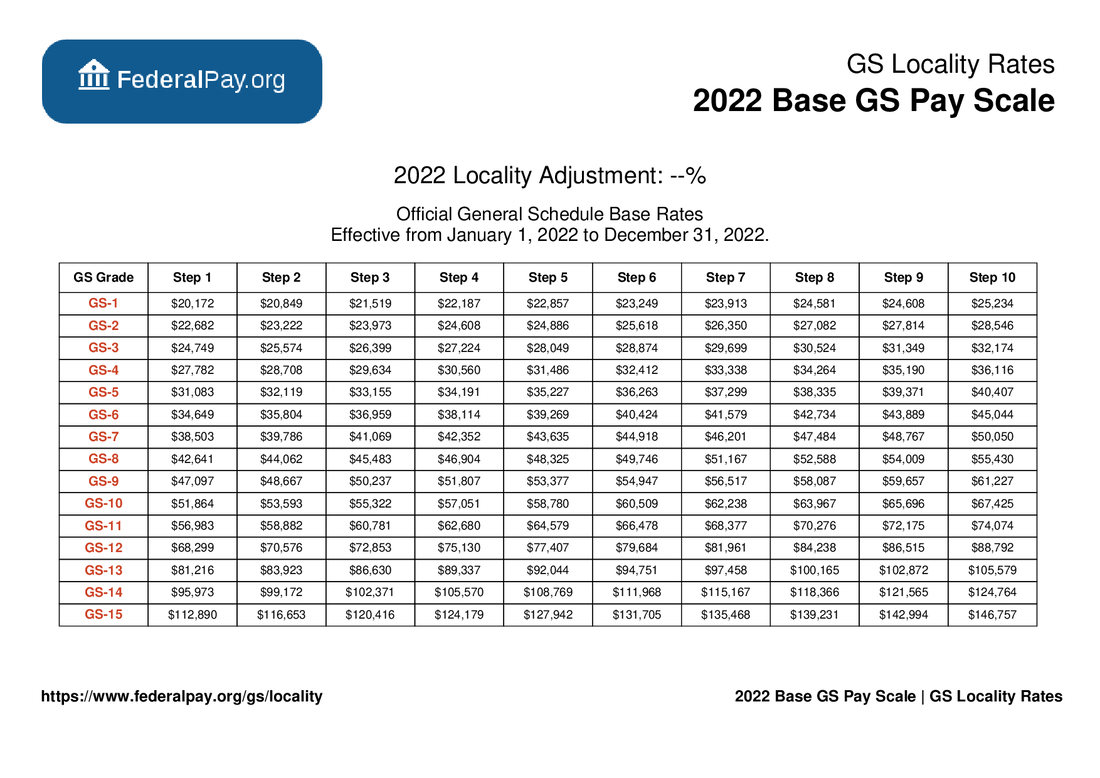

2023 Paid Family Leave Payroll Deduction Calculator. See IRSgov for details. To view the GS Pay Scale table for the current year or other historical years choose any year from the.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Try out the take-home calculator choose the 202223 tax year and see how it affects. We use the most recent and accurate information.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Free Unbiased Reviews Top Picks. Retirees will find out in October how much extra money they might get each month from a cost-of-living adjustment to Social Security in 2023.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. How You Can Affect Your Texas Paycheck. It will be worth 30000 at the end of the lease so your lease cost before interest taxes and fees will be 15000.

Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Use this simplified payroll deductions calculator to help you determine your net paycheck. Ad Compare This Years Top 5 Free Payroll Software.

If you want to boost your paycheck rather than find tax. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Dare To CompareIT This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

You will have to pay between 009 and 62 rates for the first 7700 of each employee in one calendar year. The rates vary depending on your industry. 2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations.

Moreover if you are a. Important note on the salary paycheck calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. And Munnell said its highly likely. How to calculate annual income.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage. A4 Price Based on Trim Look up vehicle price.

The EX-IV rate will be increased to 176300. Ad Create professional looking paystubs. You want the 50000 car and have negotiated the price down to 45000.

Begin tax planning using the 2023 Return Calculator below. The official 2023 pay table will be published here as soon as the data becomes available. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

It can also be used to help fill steps 3. So your big Texas paycheck may take a hit when your property taxes come due. For example if an employee earns 1500.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross.

General Schedule Gs Base Pay Scale For 2022

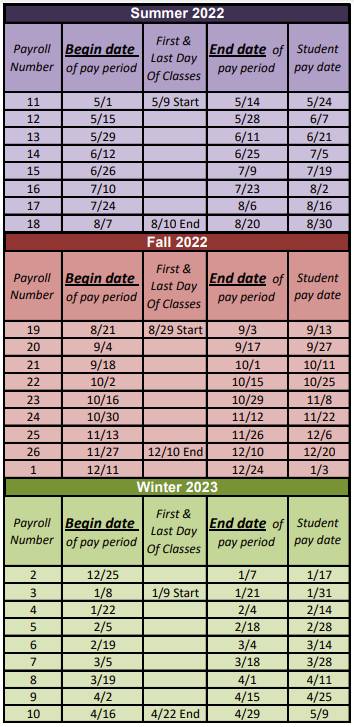

Pay Periods And Pay Dates Student Employment Grand Valley State University

Projected 2023 Va Disability Pay Rates Cck Law

Texas Paycheck Calculator Adp

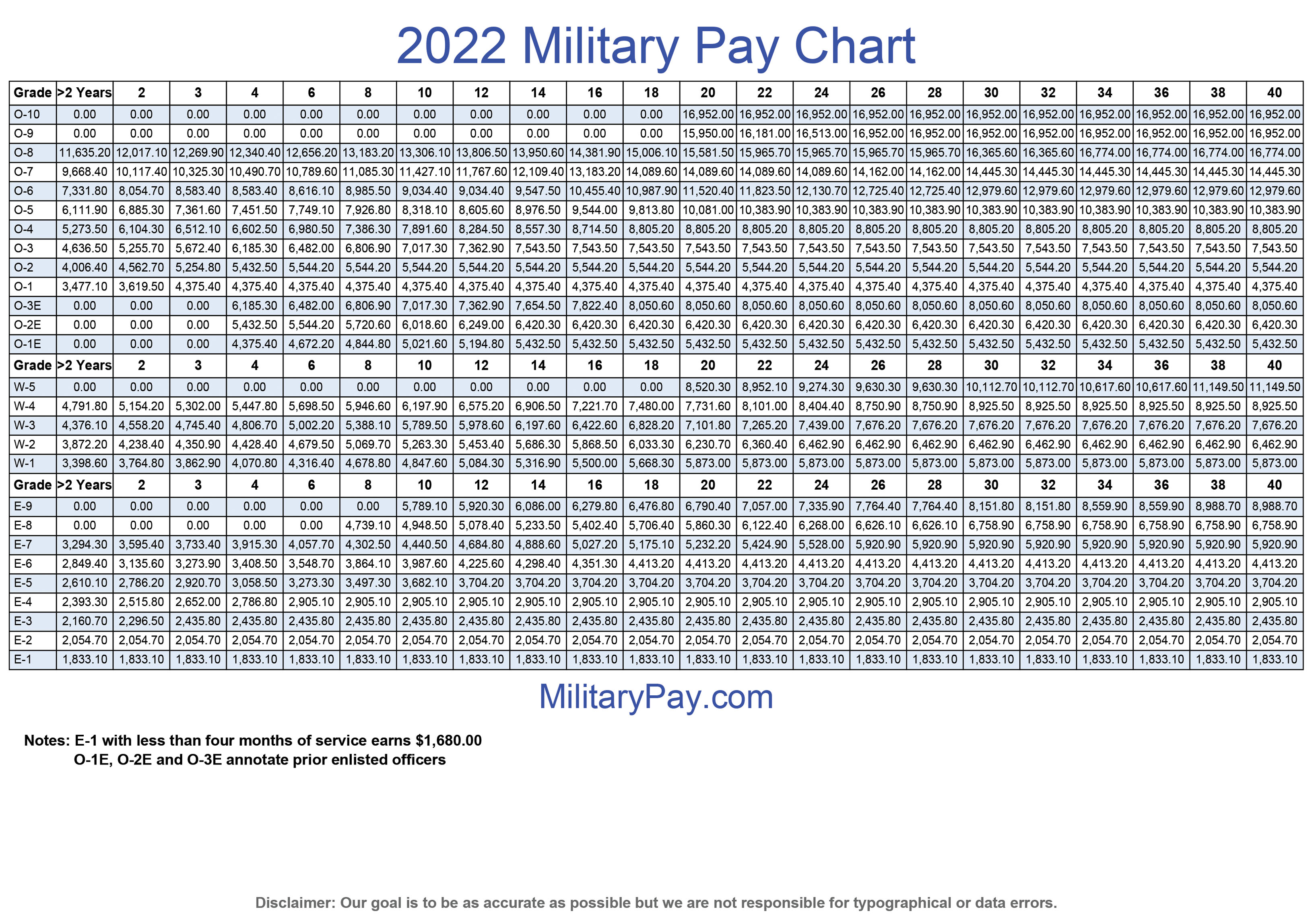

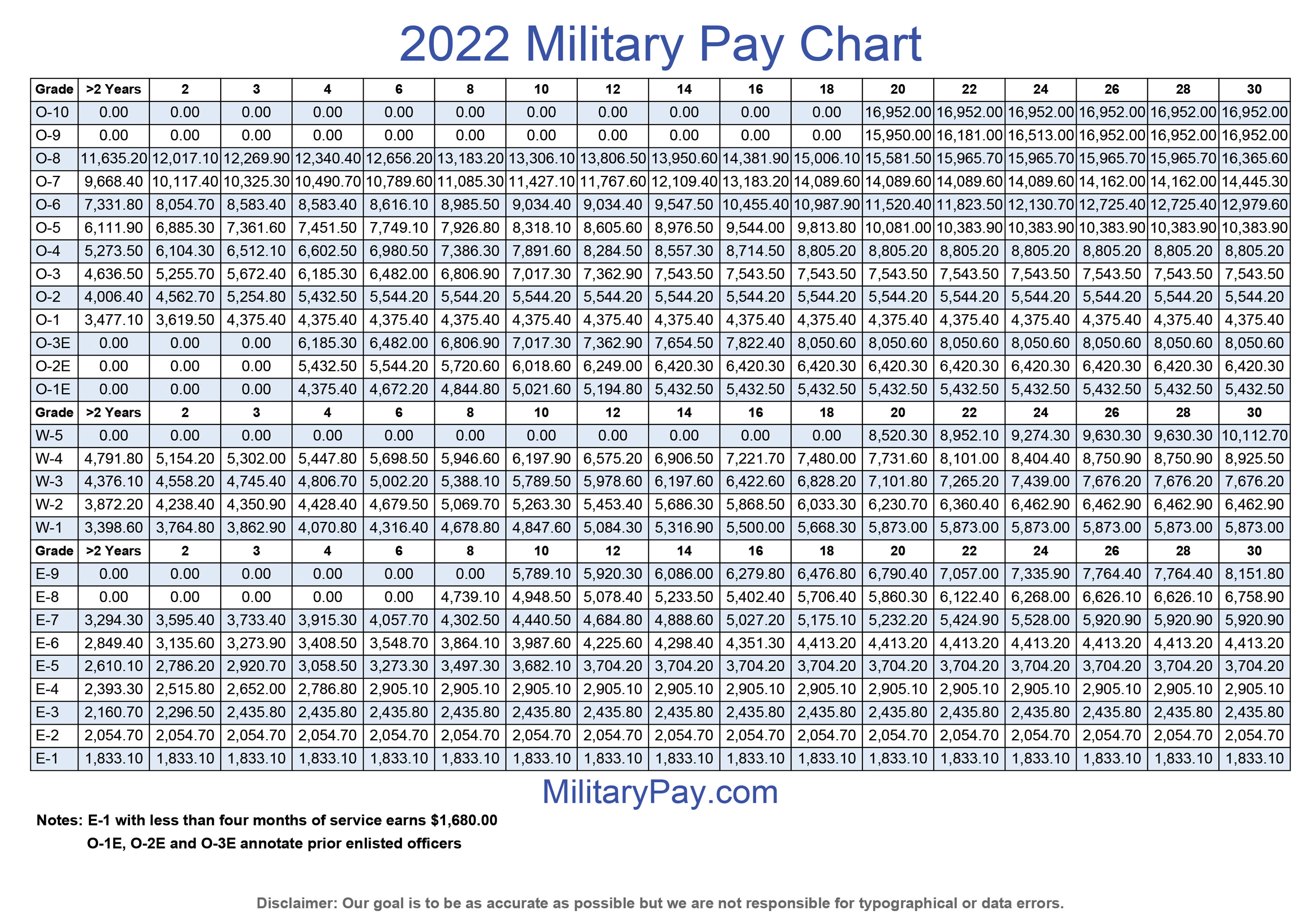

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

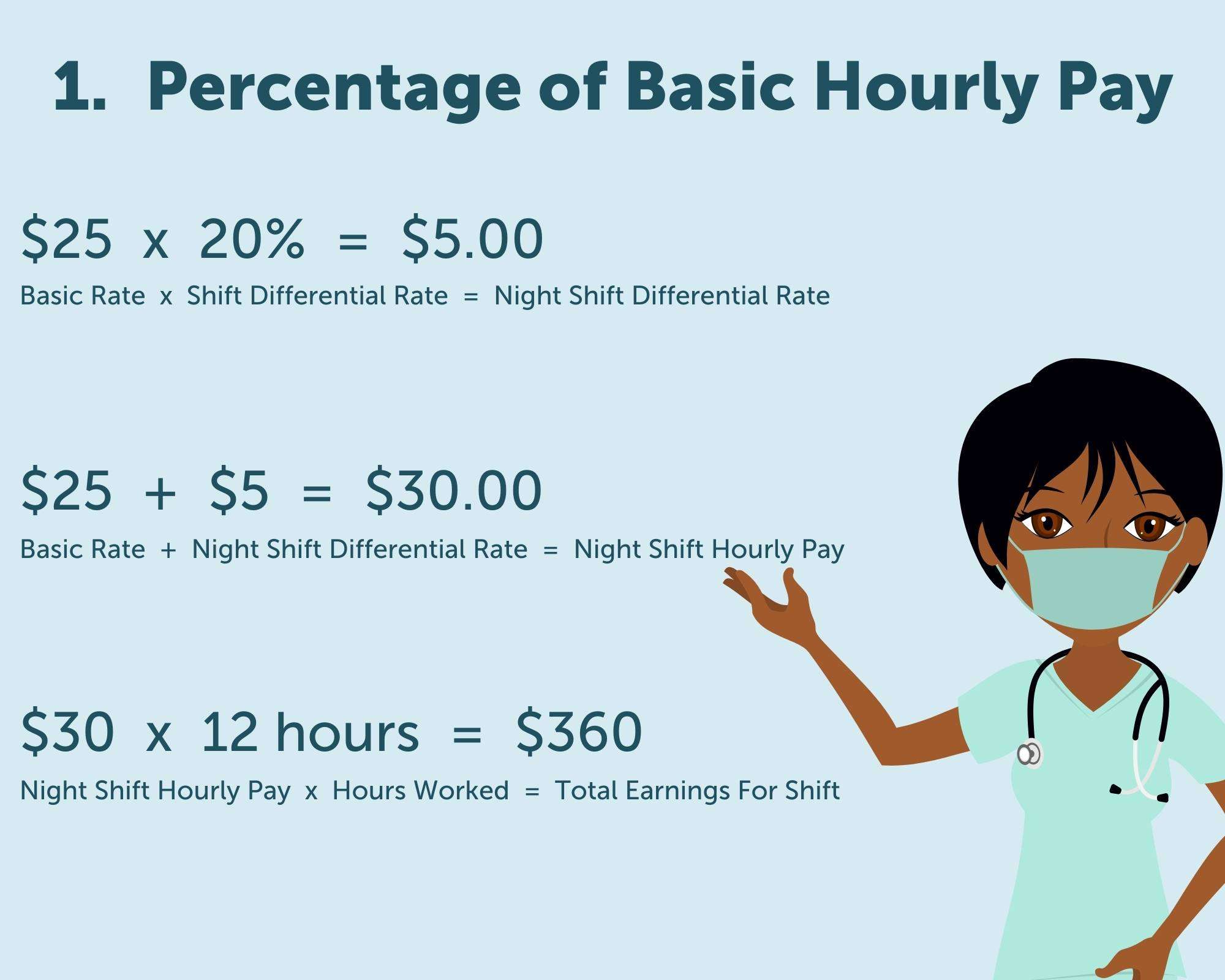

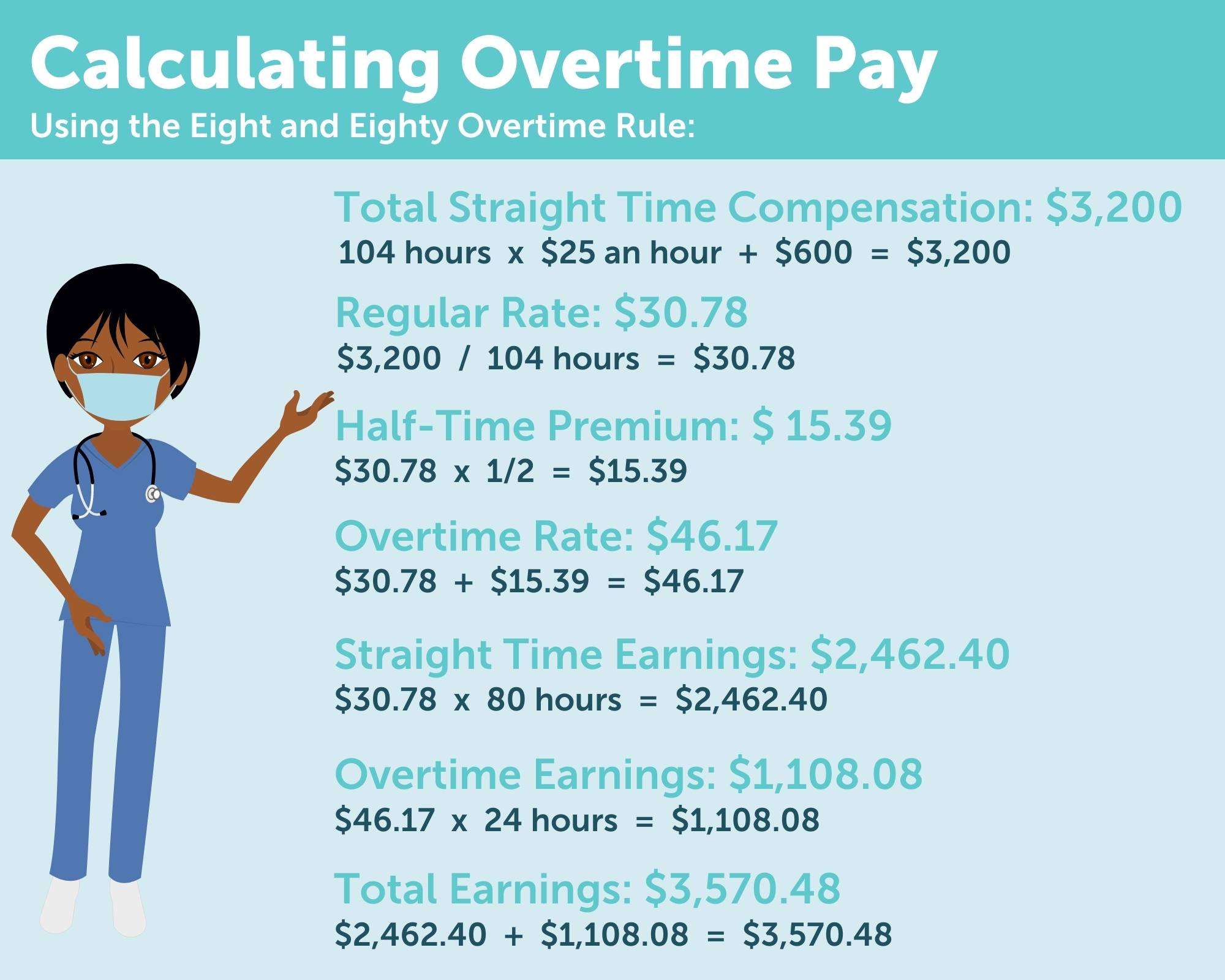

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Payroll Calendar Los Angeles City Controller Ron Galperin

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Ts Prc Calculator 2023 For Teachers Employee Salary With New Fitment

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator